欧洲热泵协会2月20日发布的行业分析报告显示,在政府支持和化石燃料价格飙升推动下,欧洲21个国家(包括非欧盟的英国和挪威)去年的热泵销量达到300万台,同比增长37%,速度超预期并创下历史新高。欧洲安装的热泵总数达到约2000万台,为约16%的住宅和商业建筑供暖。在德国,热泵的销量去年猛增了53%,达到23.6万台。欧盟的政策制定者希望通过热泵技术减少二氧化碳排放,并降低对进口化石燃料的依赖。

欧洲热泵协会秘书长托马斯·诺瓦克说,对部件短缺和新冠后市场不确定性的担忧导致该行业的一些人低估了其潜在增长。

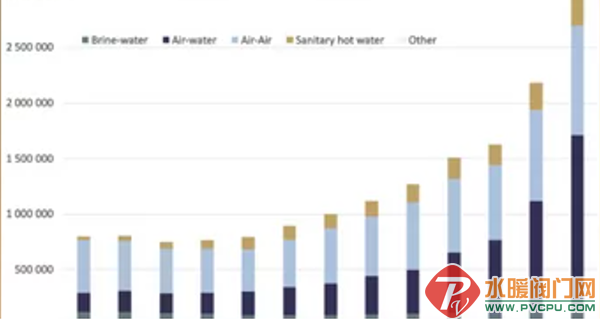

根据来自16个市场的早期数据,2022年欧洲热泵市场打破了新纪录,售出约300万台。欧洲热泵协会(European Heat Pump Association)收集的2022年数据显示,其年销售额增长了近38%,超过了前一年34%的空前增长。欧洲连接的供暖热泵(空气对空气和“水循环”或水基)和热水热泵的总数目前约为2000万台。他们为欧洲约16%的住宅和商业建筑提供供暖。

2022年售出的热泵数量替代了约40亿立方米(bcm)的天然气,避免了约800万吨(Mt)的二氧化碳排放。欧洲的整个热泵存量现在避免了5400万吨的二氧化碳——大约相当于希腊的年排放量。鉴于需要根据气候紧急情况进行脱碳,并按照REPowerEU计划中的规定远离化石燃料,这种非凡的增长可能会继续下去。政府对欧洲供暖能源转型的支持证明了采取行动的迫切需要。

欧洲热泵协会秘书长托马斯·诺瓦克表示:

“2022年是一个非凡的一年。热泵的惊人增长证明了一个创新和可持续的行业,该行业正在竭尽全力提高产能,并相应地创造就业机会,帮助气候行动和稳定能源账单。但欧洲仍有许多人没有热泵,原因包括行业产能不足、前期成本不足、组成我们正在与一个组织联盟和欧盟委员会密切合作,制定一项解决这些关键问题的欧盟热泵计划。”

2022年的销售额是在极具挑战性的市场环境下实现的,整个价值链的利益相关者都在努力提高换热器、风扇、压缩机和半导体的产能和供应链。在最终用户层面上,需要解决信息缺口以及前期和运营成本问题,以确保未来的持续需求。制造业利益相关者和行业协会正在与智库、非政府组织和其他机构合作,为欧盟委员会即将出台的热泵计划提供投入,以确保解决这些问题。

一些障碍可能会在地方一级得到缓解。欧洲各地的行业和劳工组织已启动培训和再培训计划,以培养更多的安装工人和训练有素的工人,例如,为欧洲技能年和欧盟技能公约做出贡献。

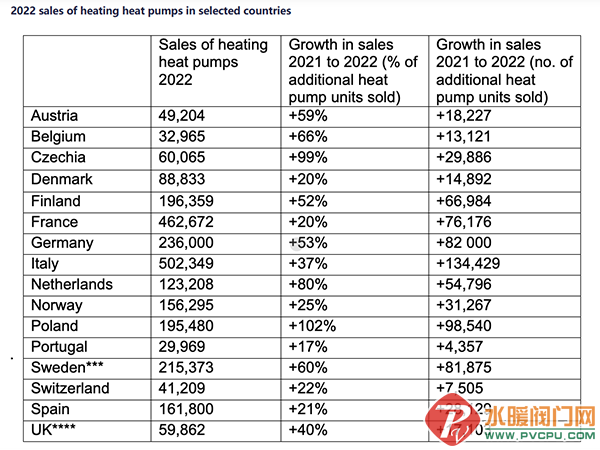

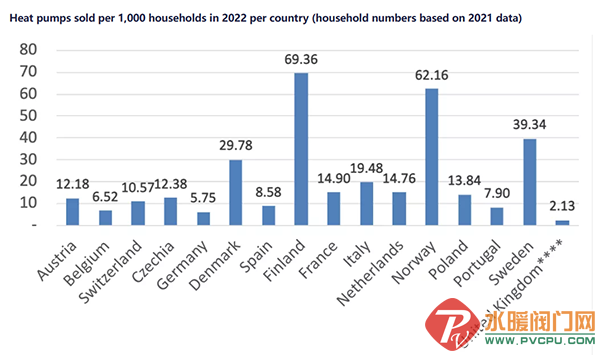

与2021相比,就供暖热泵销售额的增长而言,波兰以略高于2021 100%的幅度领先,其次是捷克(99%)、荷兰(+80%)、比利时(+66%)、瑞典(+60%)、奥地利(+59%)、德国(+53%)和芬兰(+52%)。第二组国家显示出20%至40%的强劲增长:英国(40%,但基于估计而非官方数字);意大利(+37%)、挪威(+25%)、西班牙(+21%)、瑞士(+22%)以及丹麦和法国(均+20%)。

原文:

The European heat pump market broke a new record in 2022 according to early data from 16 markets*, with around 3 million units sold. Figures for 2022 gathered by the European Heat Pump Association indicate growth of almost 38%, more than the previous year’s unprecedented rise of 34% in annual sales. The total number of connected heating heat pumps (both air to air and ‘hydronic’ or water-based) and hot water heat pumps in Europe is now around 20 million. They are providing heating to about 16% of Europe’s residential and commercial buildings**.

The number of heat pumps sold in 2022 replace roughly 4 billion cubic metres (bcm) of natural gas, avoiding about 8 million tonnes (Mt) of CO2 emissions. Europe’s entire heat pump stock now avoids 54 Mt of CO2 – roughly equivalent to the annual emissions of Greece. The extraordinary growth is likely to continue given the need to decarbonise in the light of the climate emergency and move away from fossil fuels as set out in the REPowerEU plan. The urgent need to act is substantiated by government support for the energy transition in heating across Europe.

Thomas Nowak, secretary general of the European Heat Pump Association said:

“2022 was a phenomenal year. The spectacular heat pump growth is testament to an innovative and sustainable sector which is doing everything to increase capacity and accordingly is creating jobs, helping climate action and stabilising energy bills. But still many in Europe do not yet have a heat pump for reasons ranging from the sector operating at capacity to upfront costs to lack of clear information. We are working closely with a coalition of organisations and the European Commission to build an EU heat pump plan which addresses these crunch points.”

The sales volume of 2022 was realised against a very challenging market environment with stakeholders throughout the value chain working at capacity and supply chains for heat exchangers, fans, compressors and semi-conductors stretched to the limit. On the end-user level information gaps and upfront and operating cost issues need to be addressed to ensure continuous future demand. Manufacturing stakeholders and industry associations are working with think tanks, NGOs and others to input into the EU Commission’s upcoming heat pump plan to ensure these points are tackled.

Some of the barriers may be eased on a more local level. Training and retraining initiatives have been started by industry and labour organisations across Europe to build up more installers and trained workers, for example, contributing to the European year of skills and the EU pact for skills.

In terms of increases in heating heat pump sales compared to 2021, Poland leads by quite a margin with slightly above +100% over 2021’s sales, followed by Czechia (99%), the Netherlands (+80%), Belgium (+66%), Sweden (+60%), Austria (+59%), Germany (+53%) and Finland (+52%). A second group of countries shows strong growth between 20 and 40%: the UK (40%, but based on estimates not official figures); Italy (+37%), Norway (+25%), Spain (+21%), Switzerland (+22%) and Denmark and France (both +20%).